All about The Dark Truth Of The Rich

Wiki Article

The 7-Minute Rule for The Dark Truth Of The Rich

Table of Contents4 Easy Facts About The Dark Truth Of The Rich DescribedSome Known Facts About The Dark Truth Of The Rich.A Biased View of The Dark Truth Of The RichThe smart Trick of The Dark Truth Of The Rich That Nobody is Talking AboutGet This Report about The Dark Truth Of The RichThe Only Guide to The Dark Truth Of The RichOur The Dark Truth Of The Rich IdeasExcitement About The Dark Truth Of The Rich

Take an active interest in where your cash is being invested and why. "We are all lifelong students when it comes to individual financing," Twight says. "Be willing to update your knowledge occasionally and relate it to what is going on on the planet, however keep your eyes on the reward." If you can't pay for to have a financial organizer handle your money, find one who will examine your portfolio and make suggestions for a one-time charge.With mindful preparation, patience, and wise cost savings, you can quickly make a million dollars by the time you retire. If you want to become a millionaire, the most essential thing you can do is begin early so you can take benefit of intensifying.

The Ultimate Guide To The Dark Truth Of The Rich

State you live in a comfy apartment or condo in an excellent area for $1,000 a month. You get a raise at work and transfer to a much better apartment or condo that costs $1,500 a month. Did you really require to move? If you want to end up being a millionaire, resist the desire to give in to way of life inflation.

The Main Principles Of The Dark Truth Of The Rich

You'll reach your financial objectives a lot quicker. Preparation for retirement can be very demanding, partially due to the fact that of all the investment choices readily available, not to discuss all the unknowns that await you. In reality, as many as 60% of working people stated they feel anxious about retirement planning. It's no surprise only 25% of Americans state they're positive that they're doing what they need to when it concerns retirement preparation.For 2023, it is $22,500, or $30,000 if you're age 50 or older. The majority of people with earned income can contribute to a standard or Roth IRA. The significant difference in between the 2 IRAs is when you pay taxes. With conventional IRAs, you can deduct your contributions the year you make them.

The Dark Truth Of The Rich Can Be Fun For Anyone

Roth IRAs work in a different way. You don't get the upfront tax break. However qualified withdrawals in official source retirement are tax-free. Those are made when you're 59 or older and it's been at least five years since you initially contributed to a Roth. No matter what kind of individual retirement account you have, the contribution limit is the same.The BASIC INDIVIDUAL RETIREMENT ACCOUNT is a tax-favored retirement plan that certain little employers (consisting of the self-employed) can set up for the benefit of themselves and their staff members. SEP IRAs can try here be developed by the self-employed and those who have a few employees in a small company. The SEP lets you make contributions to an IRA on behalf of yourself and your workers.

The 15-Second Trick For The Dark Truth Of The Rich

If you begin early and save regularly, you can make a million dollars by adding to your retirement savings accounts. To take complete benefit, attempt to contribute the maximum limitation. Let's take an appearance at how a typical person, let's call him Joe, can reach this million-dollar objective by the time he retires at age 67.Joe takes complete advantage of the employer match and delays 5%, or $2,500, of his wage each year. Of course, in genuine life, he 'd likely get a raise and his nest egg would grow even more.

What Does The Dark Truth Of The Rich Do?

You can pay for to sock away less cash when you're younger since you have more time to accumulate your wealth and you can tolerate more threat. If you postponed conserving till you're older, you'll need to put away more money monthly. Unless you come from a very rich household, are expecting to win the lottery game, or are on the edge of getting a patent on the next great development, there's really little opportunity that you can end up being rich by not doing anything.

A Biased View of The Dark Truth Of The Rich

Rather, they typically take deliberate actions to make cash and develop wealth. Prior to you get begun on ending up being abundant, develop a financial strategy (The dark truth of the rich).

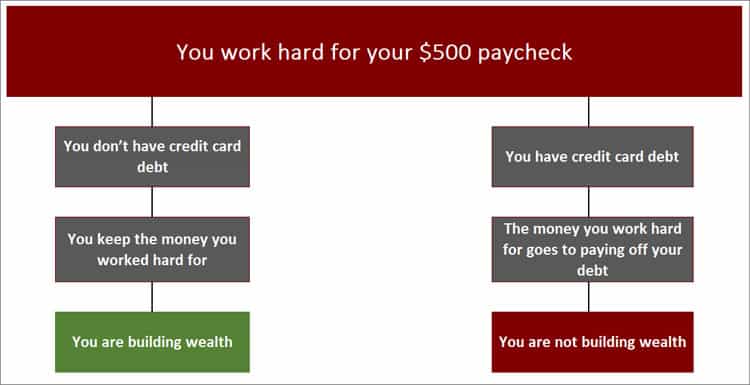

Debt with high rate of interest, such as credit card his comment is here debt, can be challenging to repay. Not only are you paying the principal amount you obtained, however you're typically paying hefty interest charges. To take control of your debt, start by listing all your loans from greatest interest rate to least expensive.

The Dark Truth Of The Rich - An Overview

You'll likely need to define that the additional payment is for the original loan quantity ask your lender if there is a specific procedure you must follow when using this method. When you have actually paid off that very first debt completely, carry on to the loan with the 2nd greatest rate of interest.

Report this wiki page